Space Tech Ecosystem

Space is the hottest emerging sector of 2026, that investors are describing as a blue ocean of opportunity to expand humanity beyond the bounds of Earth. The major players in the space economy now are building the orbital economy and for the multi-planetary future over next 10-20 years.

There is a big uptick in the launch providers (the charge being led by SpaceX), alongside hardware, logistics, communications and manufacturing companies. This is further delineated into in-orbit service providers, which includes space mining, Earth observations, scientific research, AI, imaging, and the emerging sector of compute platforms in orbit.

Space Economy Challenges

While the opportunities are huge, the space economy is still restrained by challenges of regulatory uncertainty, supply chain constraints, and launch costs; all major considerations in low Earth orbit (LEO) launches.

While innovation and increased market sector growth will overcome many these challenges, the challenge of space debris and safety concerns will continue to rise. LEO is becoming increasingly congested, with the number of satellites predicted to double from over 12000 that are already flying overhead. To address this challenge, it opens the market to a new sub-sector of providers and researchers using AI to analyze movement of space debris, and hardware solutions for removing debris from LEO.

A Global Marketplace in LEO

We can expect to see over the coming decade, a shift from space as a testbed for innovation to an orbital marketplace. Low Earth orbit (LEO) has already become prime real estate with an increase in investment going into LEO satellites and infrastructure, and dramatic incline of satellites orbiting Earth.

Emerging Opportunities in the Space Tech Economy

As new investment and technology trends emerge over the coming months and years, many opportunities will unlock across different sectors of the industry. Below are a few that will enable broader infrastructure for space:

- Lunar operations, such as water deposit extraction

- Orbital construction and manufacturing in space

- AI and robotics for asteroid mining and maintenance in orbit

- Launch ride-shares and space transport platforms

- Space energy production (e.g., solar power, fusion, etc.)

Future of the Space Tech Economy

The future of the space tech economy is only set to expand. With the increase in revenue produced from the space tech economy projected to double from $613 Billion in 2024 to over $1.8 Trillion in 2035.

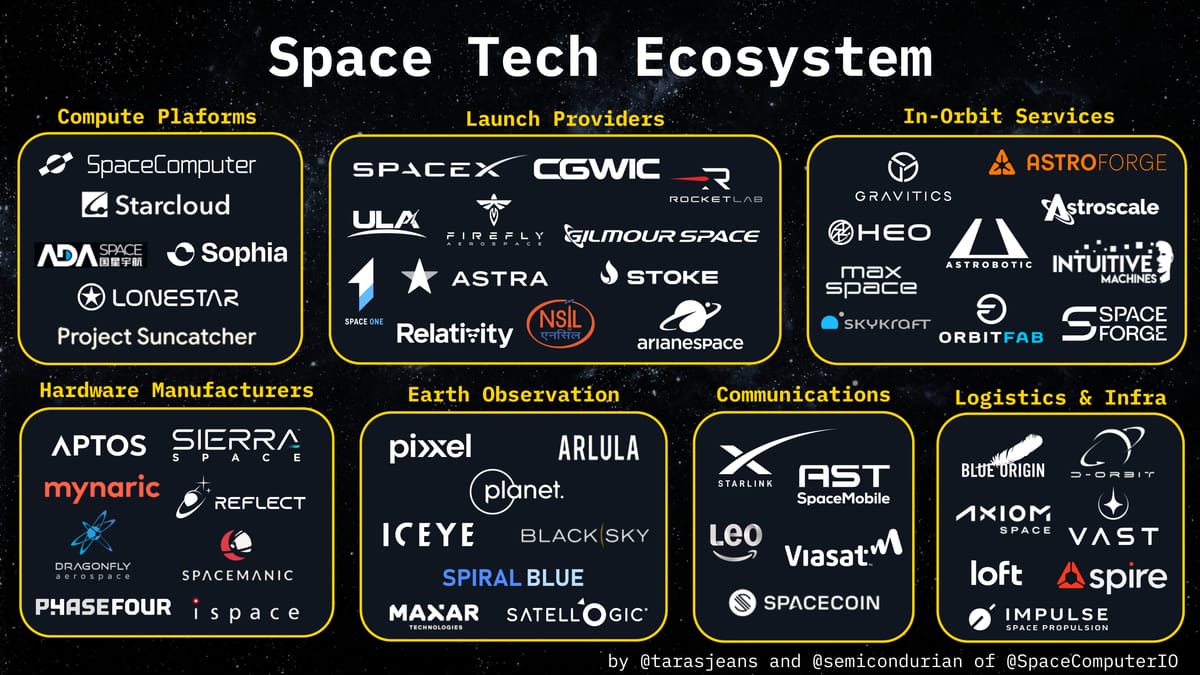

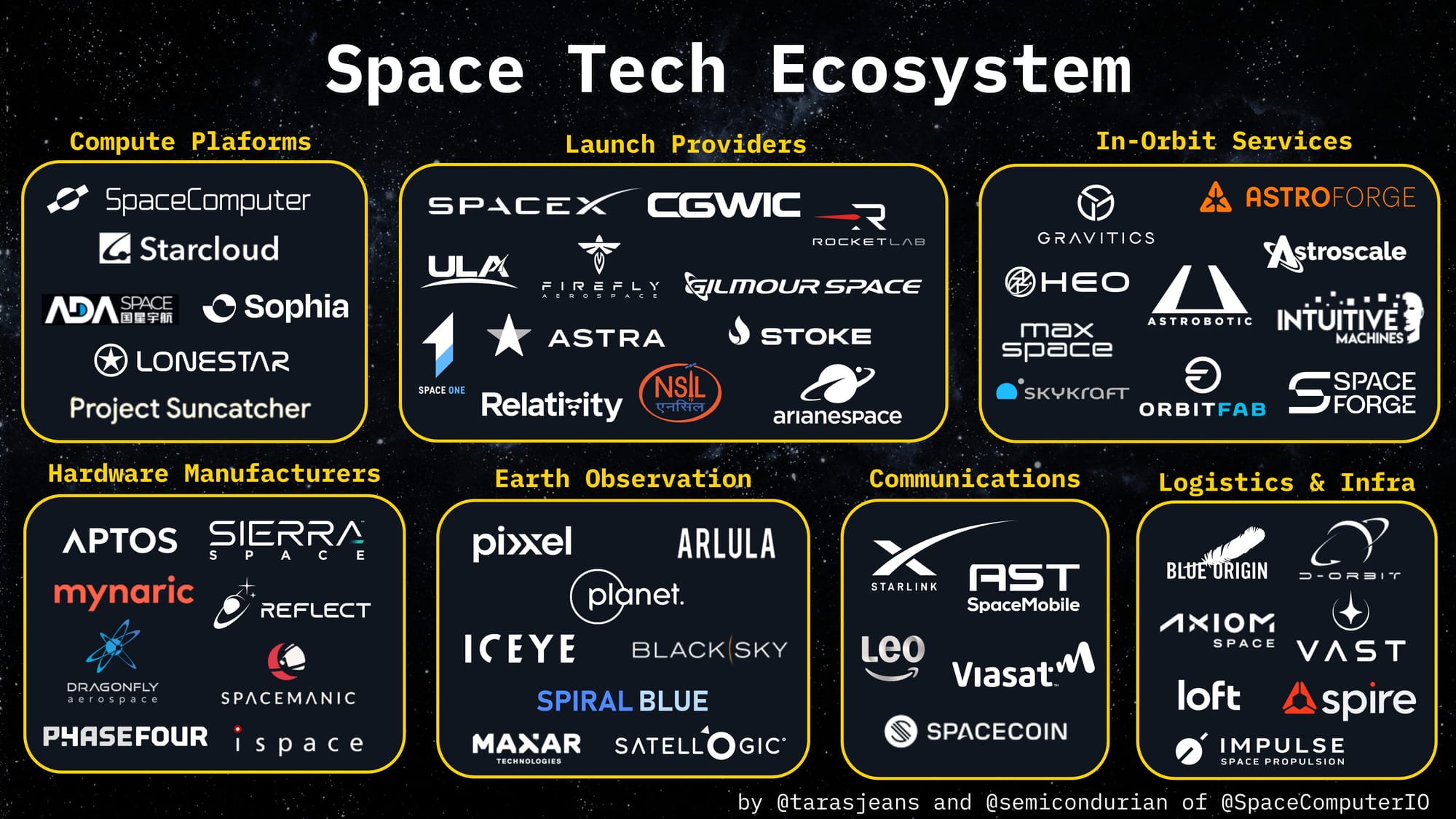

Below is a display and breakdown of major economic players by sector. While it is not an exhaustive list of the sector in its entirety, it does encapsulate global players beyond the US market, which is attributed to approximately 50% of the industry companies and revenue.

Main Space Economy Players by Sector

Launch Providers

Rocket Lab is providing end-to-end space services including the Electron small-lift launch vehicle, spacecraft manufacturing, and satellite components with 80+ successful launches.

SpaceX created Falcon 9, Falcon Heavy, Starship and the Starlink satellite constellation to make space access affordable and enable life on other planets.

United Launch Alliance (ULA) is a joint venture between Boeing and Lockheed Martin providing reliable launch services with Atlas V and Vulcan rockets, primarily serving national security and NASA missions.

Arianespace is Europe's leading launch service provider operating rockets for commercial, governmental, and scientific missions.

Firefly Aerospace is developing small and medium-lift launch vehicles (Alpha and MLV), lunar landers (Blue Ghost), and in-space transportation to increase access to orbit and beyond.

Relativity Space serves the Low Earth Orbit (LEO) constellation market with Terran R to make access to space more reliable and routine.

NewSpace India Limited (NSIL) is India's commercial arm for space activities, providing launch services, satellite building, and technology transfer from ISRO to industry.

Space One is Japan's first private orbital launch company developing the Kairos small satellite launcher for responsive and affordable space access

Gilmour Space is the leading launch services company in Australia for global Commercial, Government and Defence customers.

Stoke Space is developing fully and rapidly reusable rockets with innovative heat-shielded second stage technology to dramatically reduce launch costs.

Astra is building launch and space services including small satellite rockets and spacecraft engines for responsive space access.

CGWIC is China's sole government-authorized commercial space organization providing international satellite launch services.

Logistics and Infrastructure

Loft Orbital is building space infrastructure with standardized satellite platforms that let customers deploy and operate missions to LEO without building their own satellites.

Spire is operating the world's largest multipurpose nano-satellite constellation to provide space-based data and analytics for maritime tracking, aviation monitoring, and weather forecasting.

Vast is developing Haven-1, the world's first commercial space station, and building next-generation habitats for long-term human presence in space.

Impulse Space is building orbital transfer vehicles to move payloads efficiently across and between orbits from LEO to GEO and beyond.

Blue Origin is developing reusable launch vehicles for orbital missions and suborbital tourism to make space accessible to all.

D-Orbit created proprietary cloud-based mission control software suite designed to control entire satellite constellations. Already developing and testing new technologies to extend the life of satellites in orbit, perform active debris removal, enable interplanetary space logistics, etc.

Axiom Space is building commercial space stations and providing crewed missions to LEO, including NASA's next-generation spacesuits.

In-Orbit Services

AstroForge is mining and refining asteroid materials in space to produce metals for use in orbit and on Earth.

Gravitics is developing modular space station infrastructure and large-diameter habitats for commercial and government use.

HEO is providing non-Earth imaging services by capturing imagery of satellites and space objects for space situational awareness.

Astrobotic is developing lunar landers and rovers to deliver payloads to the Moon for NASA, commercial clients, and governments.

Skykraft is an Australian company building a constellation for space-based air traffic control and surveillance.

Astroscale is developing technologies and services for space debris removal and satellite life extension.

OrbitFab is building the first satellite refuelling infrastructure in space to extend satellite lifetimes.

Intuitive Machines is providing lunar access services with robotic landers, achieving the first commercial lunar landing in 2024.

Space Forge is manufacturing high-value materials in microgravity aboard returnable satellites for Earth-based applications.

Max Space is developing inflatable space habitats and structures to provide affordable volume in orbit.

Data and Earth Observation

Pixxel is building a constellation of hyperspectral Earth imaging satellites to detect and monitor environmental changes invisible to traditional cameras.

Arlula is creating a marketplace platform that aggregates and delivers satellite imagery from multiple providers.

Planet is operating the largest constellation of Earth observation satellites to provide daily imagery of the entire planet for monitoring change.

Maxar is Leading space infrastructure and Earth intelligence company providing satellite imagery, geospatial data, and spacecraft manufacturing.

ICEYE, based in Finland, is operating the world's largest SAR satellite constellation for all-weather, day-and-night Earth observation and monitoring.

Satellogic is operating a constellation of high-resolution Earth observation satellites to remap the planet weekly.

Spiral Blue Developing edge computing and has launched 10 NVIDIA computers into orbit onboard customer and partner missions. Also developing LiDAR in space for Earth Observation for processing satellite imagery onboard spacecraft in orbit.

BlackSky is providing real-time geospatial intelligence with a constellation of high-revisit Earth observation satellites

Hardware Manufacturers

Reflect Orbital is deploying space mirrors to reflect sunlight to Earth for nighttime solar energy generation.

Aptos Orbital is providing satellite operations services and ground station networks.

Sierra Space is building the Dream Chaser spaceplane, space station modules, and in-space manufacturing platforms.

Mynaric is manufacturing laser communication terminals for aircraft, UAVs, and satellites to create high-speed data networks in space.

Dragonfly Aerospace is a South African company manufacturing small satellite platforms and providing imaging payloads.

Phase Four is developing radio frequency thrusters for satellite propulsion that are safer and more efficient than traditional systems.

iSpace is a Japanese company developing lunar landers and rovers for commercial Moon missions and resource utilization.

Spacemanic, based in Czech Republic, is the company developing nanosatellites and providing space engineering services.

Communications

Starlink is SpaceX's satellite internet constellation providing global broadband connectivity from space.

AST SpaceMobile is building the first space-based cellular broadband network directly accessible by standard smartphones.

Viasat is providing global satellite communications and internet services for consumers, aviation, and maritime markets. If you've used wifi on a US airline, it's likely Viasat.

Amazon LEO, previously Project Kuiper, is Amazon's constellation of LEO satellites to provide global broadband internet.

Spacecoin is developing decentralized infrastructure for internet connectivity via LEO nano-satellite constellation.

Compute Platforms

SpaceComputer is building decentralized satellite compute infrastructure using physically tamper-resistant CubeSats as Trusted Execution Environments.

Starcloud is building Space data centers focused on training AI models, with proof of concept wit NVIDIA H100 in space.

ADA Space is the Chinese commercial space company developing satellites and launch services (Chengdu Guoxing Aerospace Technology Co)

Sophia Space is building edge computing platforms for processing data in orbit before downlinking.

LoneStar Data Holdings provide secure data storage spacecraft at the Earth Moon L1 Lagrange Point, connecting line of sight to our the facilities of our data center partners on Earth.

Google Suncatcher is beginning research to explore how an interconnected network of solar-powered satellites, equipped with our Tensor Processing Unit (TPU) AI chips, could harness the full power of the Sun.

This breakdown of the space tech economy is brought to you by the team at SpaceComputer. Thoughtfully put together by yours truly, Tara Jean and Daniel Bar.

For more information, visit spacecomputer.io

→ Join the SpaceComputer community

→ Follow us on Twitter (X).